Calculate Your Solar Payback Period

(Update: The Residential Solar Tax Credit will no longer be eligible after 12/31/25.)

Your Solar Payback Calculator

The sun is an incredibly powerful source of free energy and harnessing all that power requires high-tech equipment that used to be too expensive. Now, the cost of solar panels has decreased by about 50% in the last decade. Enabling over 1 million people to power their homes with renewable energy. Solar has become a smart investment as panel prices fall and utility rates rise. However, many people are still questioning whether or not it makes sense for them to pull the trigger on their solar purchase. Vivint Solar’s CEO, David Bywater states he: “Expects solar to remain a consultative purchase for now. “If [owners] are putting a $30,000 to $40,000 investment in their home, they want to make sure it’s the right solution for them”. Of course, Consumers should put a fair amount of consideration into a purchase of this size. The best place to start is by using the solar payback calculator or “break-even point”.

How Long is the Payback Period?

One of the main questions when investing in solar is how long will it take to make back your money in order to start seeing savings. This period of time is referred to as the payback period and is the time in which your initial investment amounts to the total revenue earned. In this case, savings earned by offsetting your bill with solar power. Like any other investment, the solar payback calculator period may vary depending on a few different factors such as:

-

- the rate you pay the utility company

-

- any added tax incentives. (Update: The Residential Solar Tax Credit will no longer be eligible after 12/31/25.)

The average time it takes for a residential solar system to pay for itself is approximately 6.9 years. This number is based upon 2017’s U.S. average system cost of $9,000 ($15,000.00 with 30% tax credit applied.), divided by the estimated annual savings for that system. To determine your annual savings, follow the equation below.

Apply the Solar Payback Calculator

The average household usage per month is around 900 kWh at $0.15 per kWh, equalling a $135 monthly utility bill. This individual is paying around $1,620.00 a year for energy, and hopes to offset their bill by at least 80% by going solar. In this example, we are assuming this is a cash purchase, which means no interest paid on financing. Lastly, take the total cost of the system after the tax credit is applied ($9,000.00) , and divide it by the amount offset by your solar each year ($1,296.00). Now that you have used the solar payback calculator, you can determine your total estimated savings. Most solar systems last around 20-25 years, backed by a manufacturer’s warranty. That is nearly $30,000.00 in savings, and that is assuming utility rates do not increase in the coming years.

Example from www.solar-power-now.com

How much does the system cost?

Total solar panel system cost = $12,857.50

Subtract the $6,000 Solar tax credit (30% in 2019) applied

= $9,000 total system cost

What are you paying annually for electricity?

Price for utility electricity – $0.15/kWh

Monthly usage – 900 kWh

=Yearly cost for electricity – $1,620

How much will you save with solar?

Utility electricity offset by solar – $1,296 (80 percent offset)

= Solar payback period is $9,000/$1,296 = 6.9 years.

The area of the country you live in may determine what you’re paying for energy, but the average cost in the United States is 12 cents per kilowatt-hour. Because residents who live in the NE and SW regions of the country pay more for electricity, they may have a faster payback period.

Cost of Electricity

It may come as no surprise that utility rates are projected to increase in the coming years. According to the EIA (Energy Information Administration), residential electricity rates have increased by 30 percent in just the last decade. This annual increase would amount to over $1,000.00 in just a 10 year period. This is another reason why many residents are considering solar as a way to power their homes. Solar is not affected by price increases the way the grid is; you can protect yourself from the rising cost of unpredictable utility rates by installing panels on your house.

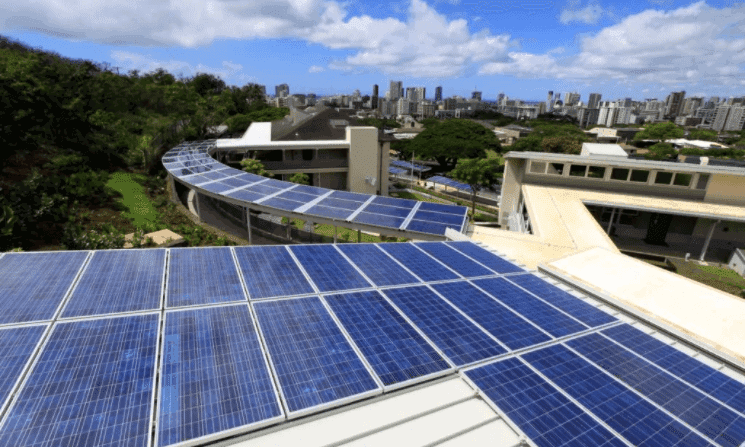

Example: Hawaiian Solar Industry

Homeowners in Hawaii pay approximately 33 cents per kilowatt-hour; this is one of the most expensive places for energy usage. For this very reason, the state of Hawaii has become one of the most prominent places for solar in the U.S. and is on target to become reliant on 100% renewable energy by 2045. The state’s senator Mike Gabbard told Think Progress, “through the process of transformation we can be the model that other states and nations follow. And we’ll achieve the biggest energy turnaround in the country, going from 90 percent dependence on fossil fuel to 100 percent clean energy.”

Cost of the System

There are a couple of things to consider when first starting the solar purchasing process. Get quotes from multiple companies to ensure you’re getting the best deal possible. This can shave several years off of your payback period, and you will get a higher return on your investment in the long run. It is also key to purchase quality products. A longer warranty on the equipment may be an indication that you will continue producing the energy necessary to offset your bill over the lifetime of the system (which can be 25-30 years). Equipment, size of the system, placement, the system’s size, orientation, equipment options, configuration, permitting, and labor will factor into the total cost of the system. Estimations will vary greatly across the country, but in the state of California solar companies are pricing anywhere from $2-4 per DC watt. The range from company to company can make all the difference ($2,000-$8,000) in your solar payback period.

What Gov. Programs & Tax Incentives are Available?

Because of the positive environmental and economical aspects of solar, the incentives of going solar make it more achievable for homeowners. Net Energy Metering (NEM) reimburses owners of residential and commercial PV solar systems for the power their solar produces at retail rates. This makes solar viable and enables homeowners to pay their solar system off in less time. Solar customers are compensated regardless of whether the energy their system produces is used in real-time.

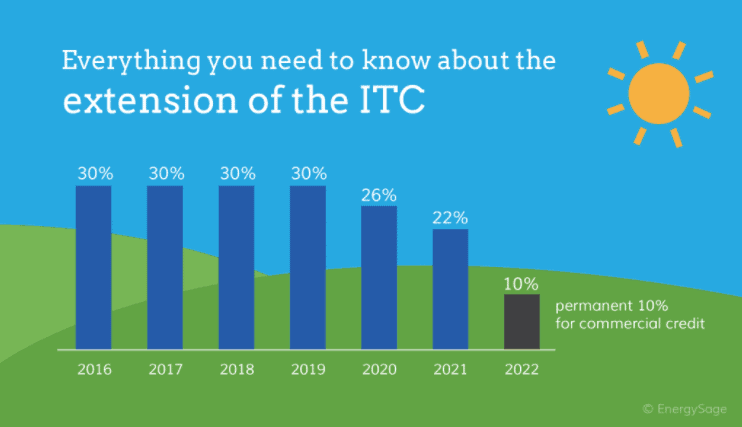

Another incentive is the Solar Investment Tax Credit or ITC is that it applies to both homes or business systems and has no max value. This 30% credit is only applicable if you are able to recover funds from a tax credit; please consult your tax professional for verification. This can have a significant impact on lowering the price of a system for qualified homeowners, and may push many residents to go solar faster.

Solar is an investment that looks different for every homeowner, and each family should do their own research and ask a lot of questions. If you have a power bill over $150 per month and you pay federal taxes, solar could be the best investment decision you ever make. The solar payback period will always be lower than the time it takes for a solar system to stop performing. This means years and years of return on your original investment to choose solar as an energy source.

To get a quote on solar panels for your home, visit Solar Negotiators and see how you can save money on electricity and help the environment.

Recent Posts

Reduce your reliance on the energy grid.

Get Solar In

Your Inbox

Refer friends and get paid in-app

The more referrals you bring in, the higher your earnings.

Earn $1,000 for each referral, and bonuses of up to $1,500 once you hit your 10th referral.