Solar Leasing: What It Is & What You Need to Know

If you’ve been thinking about going solar, you should know that there are a few financial options that you can use when making the switch. When customers decide to go solar, they must choose between a cash purchase, loan, PPA, or solar lease. If a customer wants to enjoy the benefits of solar panels but is worried about the cost of getting a solar system, they often think leasing is their best option. However, there are many other factors to consider when making the decision on solar. We understand it can be difficult to navigate all the different options, so we’re here to help you understand more about solar leasing.

Is Solar Leasing Right for You?

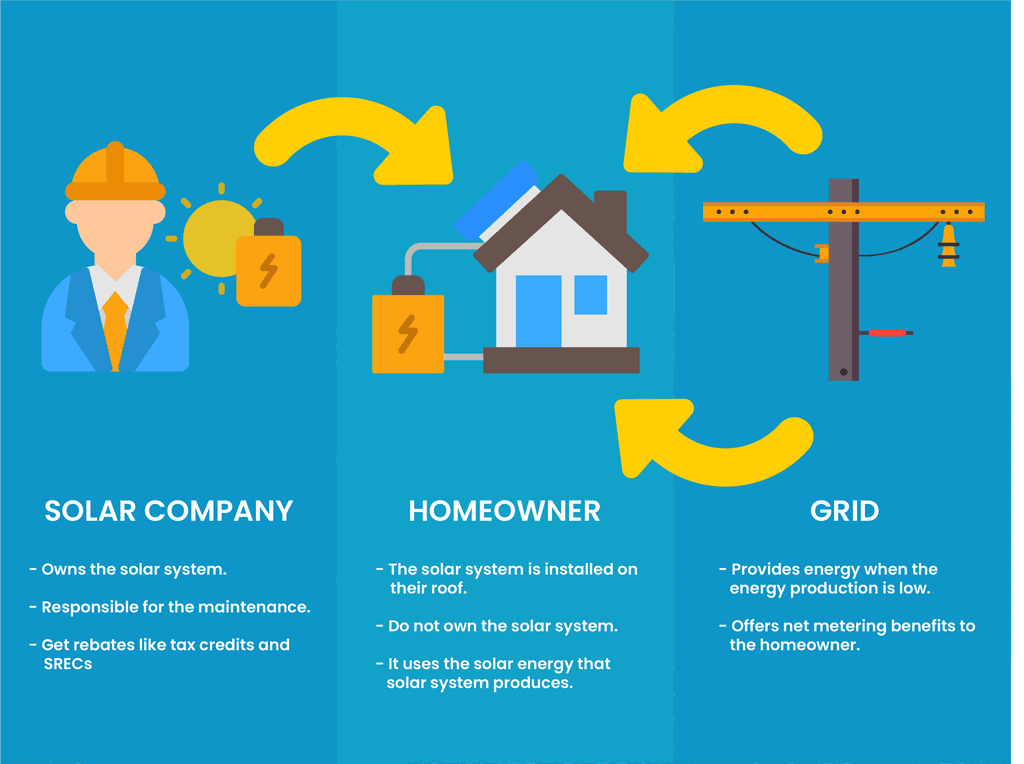

If you opt to purchase panels, you own the solar system. What does this mean for you? Over time, you will have paid off the system completely while being protected from rising energy costs. Solar leasing is a financing option where a homeowner does not own the solar system on their roof, but instead pays a monthly lease payment to a solar company in exchange for the energy the solar panels produce. The whole idea is to provide customers a way to reduce their bills without taking on the debt of borrowing money to fund their solar project. And while it is true that leasing can help you get a solar system with no upfront cost, there are many financing options that also offer no money down.

The Power Purchase Agreement: Explained

Another PV financing option is called Solar Power Purchase Agreement, or PPA. When looking at leasing and Solar Power Purchase Agreements, it’s important to know that (fundamentally) they are the same product. Both come with a zero-down cost when installed, and you must sign a contract that gives the company ownership of the solar system. The difference between a solar lease and a solar PPA is simple: with a lease, you pay a fixed monthly price to use the system. With a PPA, you pay a fixed price per kWh for power generated. The PPA does allow you to take advantage of net energy metering benefits. However, because you don’t own the system, you do have to send a monthly payment to the PPA company for each kilowatt hour of solar energy you use.

Is There a Better Solar Financing Option than Leasing?

Choosing to lease or go solar through a Power Purchase Agreement will only offer a fraction of the total savings generated by owning your solar panels. This is for a few different reasons. First, if you lease your solar, you no longer qualify for the Federal Investment Tax Credit for Solar. This allows homeowners to get 26% back on their tax refund for what they paid towards solar installation costs. This greatly reduces the time it takes to make back the investment they made into purchasing solar panels for their home. Second, once you are done paying off your solar system you are only having to pay your annual True-Up costs. For Solar Negotiators clients, this usually averages somewhere between $100-500 per year (including minimum charges paid to the utility to stay connected to the grid). Lastly, leased systems are usually heavily undersized for the needs of the household. The average offset of a leased system is usually between 15-40% of the annual household energy consumption. This excess energy consumption will lead to a remaining net debit, leaving the solar customer with added energy costs they were trying to avoid.

Is a Solar Lease Worth it?

Whether you buy or lease your solar system, you still get to save money on your monthly utility bill. Homeowners get to use all of the electricity the solar panels produce, reducing their monthly utility bills. However, solar ownership will offer a better return on investment and allow homeowners to better capitalize on energy savings. Because you do not own the solar system, it will not become an asset to your home. Since you must pay the solar company every month for the length of your lease, you will save money on your energy bill, but it’s typically not as much in the long-term compared to owning the panels yourself. Leasing solar is cutting your savings down. You will also not be able to take advantage of all the benefits like tax deductions and tax credits. To gain the most benefits from solar power, we feel it would be best to either take full ownership of your system through a cash purchase or financing option.

Pros of Solar Leasing

- No upfront cost: You are not required to put money down for installation.

- Free maintenance: If something happens to your system, the leasing company will fix it. Once again, you save as the leasing company insures the system.

- Utility bill savings: You will save about 15-40% of the current utility bill price, depending on the size of your system.

- Reduced household carbon footprint: With solar panels, you can provide for the electricity needs of your home.

- The system is guaranteed: Power production guarantees in solar leases mean payments can decrease if the panel doesn’t produce as anticipated, minimizing the risk.

Cons of Solar Leasing

- It costs more in the long run: Even when you save on the upfront cost when you lease solar panels, you will pay more over time vs financing. It’s the same as renting a house instead of buying one; the price may be low when you start but purchasing an asset and having ownership leads to more significant savings.

- You don’t receive rebates or tax credits: A solar panel lease does not receive the 26% Federal Tax Credit or any local incentives, which makes this one of the most significant disadvantages of getting a solar lease.

- Having a lease can scare away homebuyers: Solar leases can help you save money from your utility bill, but the panels must remain on the property of the solar customer. It doesn’t add resale value to the home, making homebuyers unwilling to continue the lease.

- You miss out on a high ROI: When you lease solar panels, you lose out on an annual return on investment of 10-30%, depending on your location, state incentives, and property characteristics.

Pre-Paid PPA (The Hybrid Model):

A newer, smarter option where a specialized business entity claims the 48E tax credit and passes most of it back to you as an upfront discount—typically 30–50% off (depending on if bonus qualifiers are met). You make one Pre-Paid payment (cash or financed), enjoy full system performance from day one, and assume ownership after six years—without ongoing payments.

Solar Negotiators is proud to announce that we can help homeowners explore the benefits of solar while still enjoying tax credit benefits in the form of upfront discounts on systems.

Solar is more affordable than ever before, but many people still don’t have the cash to purchase a solar system. Just know that solar leasing can be profitable over the contract’s lifetime, but customers who can buy the systems outright will receive more financial benefits. Buying your solar system will give you the best return on investment. Overall, before settling on the solar lease, you should weigh all your options and consider getting a solar quote from multiple local solar contractors.

Give our team a call today at 559-447-1557 to get started with a free solar consultation. Find out how much money you can save with solar ownership.

Recent Posts

Reduce your reliance on the energy grid.

Get Solar In

Your Inbox

Refer friends and get paid in-app

The more referrals you bring in, the higher your earnings.

Earn $1,000 for each referral, and bonuses of up to $1,500 once you hit your 10th referral.